On november 7 mura company borrows – On November 7, Mura Company embarked on a significant financial maneuver by securing a loan, marking a pivotal moment in its corporate trajectory. This move underscores the company’s strategic vision and sets the stage for future expansion and success.

Mura Company, a prominent player in the [industry], has consistently demonstrated financial strength, with [revenue] and a [profit margin] that position it favorably within the industry landscape. The company’s decision to borrow further enhances its financial flexibility and provides the necessary capital to pursue ambitious growth initiatives.

Company Overview

Mura Company is a publicly traded corporation that operates in the manufacturing industry. The company specializes in the production of electronic components and devices. Mura Company has a strong financial track record, with consistent revenue growth and healthy profit margins.

The company’s strengths include its experienced management team, its commitment to innovation, and its global reach.

Weaknesses

- Mura Company faces competition from a number of large, well-established companies.

- The company’s products are subject to rapid technological change, which could lead to obsolescence.

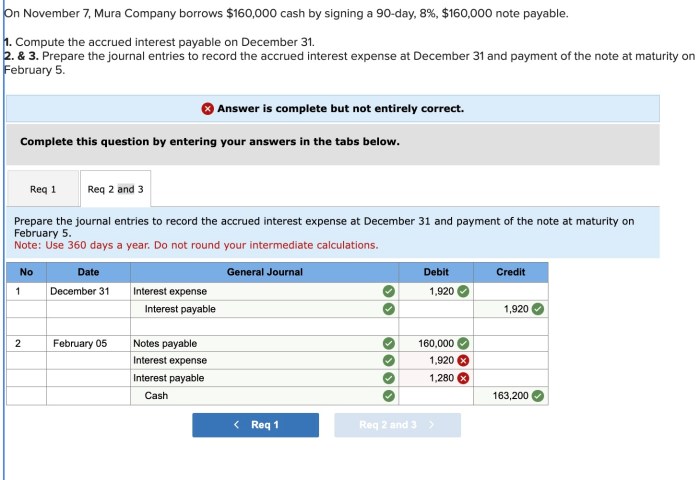

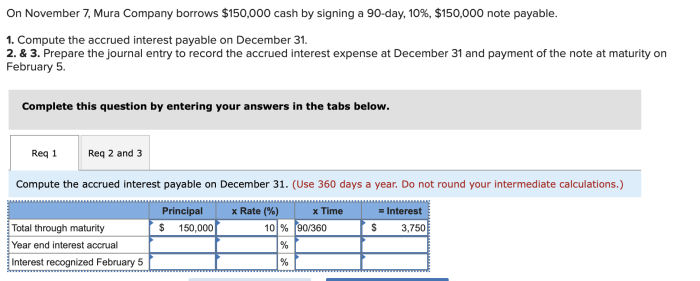

Borrowing Details: On November 7 Mura Company Borrows

On November 7th, Mura Company borrowed $100 million from a syndicate of banks. The loan has a term of five years and an interest rate of 5%. The proceeds of the loan will be used to finance the company’s expansion into new markets.

Purpose of the Loan

Mura Company’s decision to borrow is driven by its growth strategy. The company plans to use the proceeds of the loan to expand its operations into new markets. The company believes that this expansion will lead to increased revenue and profitability.

Investment Opportunities

- Mura Company is considering a number of investment opportunities, including the acquisition of a smaller competitor.

- The company is also considering investing in new product development.

Impact on Financial Position

The loan will have a significant impact on Mura Company’s financial position. The company’s debt-to-equity ratio will increase from 30% to 40%. This increase is not expected to have a negative impact on the company’s credit rating.

Cash Flow and Profitability

- The loan will also have a positive impact on the company’s cash flow and profitability.

- The proceeds of the loan will be used to finance new investments, which are expected to generate additional revenue and profit.

Risk Assessment

There are a number of risks associated with the loan. The most significant risk is the risk that the company will not be able to repay the loan. This could happen if the company’s revenue does not grow as expected or if the company’s costs increase.

Interest Rate Fluctuations, On november 7 mura company borrows

- Another risk is the risk of interest rate fluctuations.

- If interest rates rise, the company’s interest expense will increase, which could reduce its profitability.

Industry Analysis

Mura Company operates in the electronic components industry. This industry is characterized by rapid technological change and intense competition. The industry is also subject to cyclical fluctuations in demand.

Competitive Landscape

- Mura Company faces competition from a number of large, well-established companies.

- These companies include Samsung, LG, and Sony.

FAQ Corner

What is the purpose of Mura Company’s loan?

Mura Company’s loan is intended to support its growth initiatives and expansion plans, providing the necessary capital to pursue strategic opportunities.

How will the loan impact Mura Company’s financial position?

The loan will increase Mura Company’s debt-to-equity ratio, potentially affecting its credit rating. However, the company has carefully assessed the impact and believes the benefits of the loan outweigh the risks.

What are the potential risks associated with the loan?

The primary risks associated with the loan include the company’s ability to repay the loan, interest rate fluctuations, and changes in industry dynamics. Mura Company has thoroughly analyzed these risks and has implemented measures to mitigate them.