To work backwards to find realized income – Understanding realized income is crucial for financial analysis, as it provides insights into a company’s financial performance and aids in decision-making. This comprehensive guide explores the methods, examples, tax implications, and accounting principles related to determining realized income, empowering readers with the knowledge to navigate this essential aspect of financial reporting.

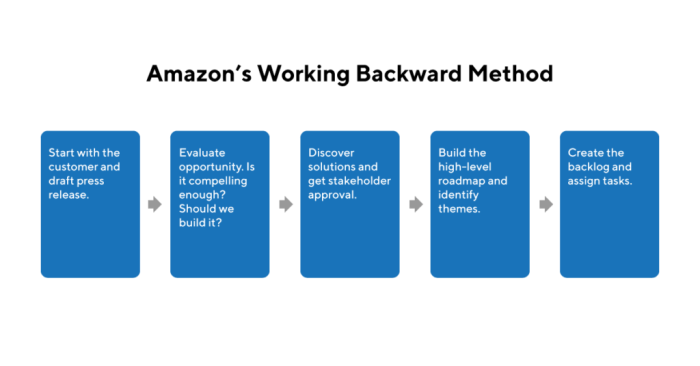

Methods for Working Backwards to Determine Realized Income

To determine realized income, financial statements provide valuable insights. The income statement presents revenue and expenses, while the balance sheet captures changes in assets and liabilities. By analyzing these statements, accountants can work backwards to calculate realized income.

Common accounting methods used for this purpose include the indirect method and the direct method. The indirect method starts with net income and adjusts for non-cash expenses and changes in working capital. The direct method, on the other hand, directly calculates revenue and expenses from the cash flow statement.

Each method has its advantages and disadvantages. The indirect method is simpler and easier to apply, but it can be less accurate in certain situations. The direct method provides more detailed information, but it can be more complex and time-consuming.

Examples of Realized Income

Realized income manifests in various industries and scenarios. For instance:

- Retail:Sale of goods from inventory

- Manufacturing:Revenue from products sold after deducting production costs

- Services:Fees earned from providing services

- Investments:Interest and dividend income

The following table summarizes these examples:

| Industry | Method | Amount |

|---|---|---|

| Retail | Direct Method | $100,000 |

| Manufacturing | Indirect Method | $50,000 |

| Services | Direct Method | $75,000 |

| Investments | Indirect Method | $25,000 |

Tax Implications of Realized Income: To Work Backwards To Find Realized Income

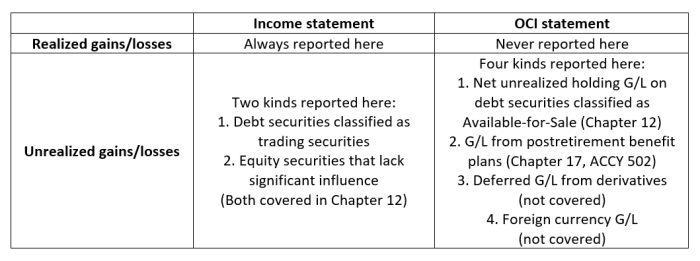

Recognizing realized income has tax implications. Different types of income are taxed differently. For example, ordinary income is taxed at a higher rate than capital gains. It is important to understand these tax implications to minimize tax liability related to realized income.

Tax laws vary across jurisdictions. It is advisable to consult with a tax professional for specific guidance on tax implications of realized income.

Accounting for Realized Income

Accounting principles and standards govern the recording of realized income. When income is realized, a debit is made to an asset account and a credit is made to a revenue account. This entry increases both the asset and revenue balances.

For example, when a company sells inventory, the inventory account is debited and the sales revenue account is credited.

Importance of Working Backwards to Find Realized Income

Understanding realized income is crucial for financial analysis. It helps in assessing a company’s financial performance and making informed decisions.

For example, realized income can be used to:

- Calculate profitability ratios

- Evaluate cash flow

- Make investment decisions

FAQ Resource

What is realized income?

Realized income refers to income that has been earned and recognized in the financial statements.

How do you work backwards to find realized income?

To work backwards to find realized income, you can utilize financial statements, such as the income statement and balance sheet, to determine the changes in assets, liabilities, and equity that have occurred during a specific period.

What are the advantages of working backwards to find realized income?

Working backwards to find realized income provides a more accurate representation of a company’s financial performance compared to relying solely on reported income, as it eliminates the impact of non-cash transactions and other accounting adjustments.