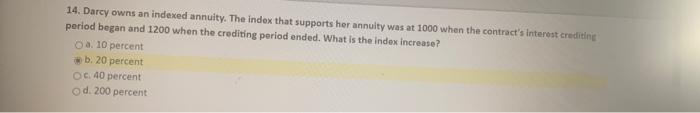

Darcy owns an indexed annuity, a smart investment vehicle that offers a unique blend of growth potential and downside protection. This guide will delve into the intricacies of Darcy’s indexed annuity, exploring its benefits, risks, and how it compares to other investment options.

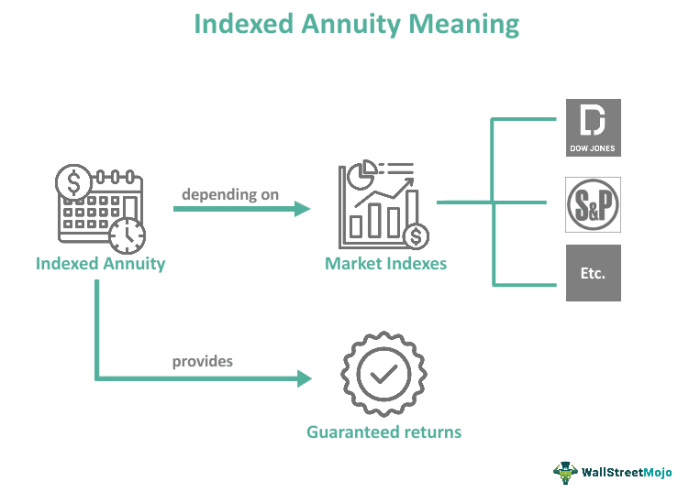

Indexed annuities are a type of fixed annuity that provides a guaranteed minimum interest rate, typically linked to an inflation index, offering protection against market downturns. They offer a steady stream of income during retirement, providing peace of mind and financial security.

Understanding Indexed Annuities

Indexed annuities are a type of annuity that provides a guaranteed stream of income for a specified period of time. They are designed to protect your retirement savings from the effects of inflation by linking the value of your annuity to an inflation index, such as the Consumer Price Index (CPI).

Types of Indexed Annuities

There are two main types of indexed annuities: fixed indexed annuities and variable indexed annuities.

- Fixed indexed annuitiesprovide a guaranteed minimum interest rate, plus a potential bonus based on the performance of an underlying index.

- Variable indexed annuitiesoffer the potential for higher returns, but they also come with more risk. The value of your annuity will fluctuate based on the performance of the underlying index.

Examples of Indexed Annuities

Some examples of indexed annuities include:

- The Vanguard Variable Indexed Annuity

- The Fidelity Income Navigator Indexed Annuity

- The TIAA Traditional Indexed Annuity

Darcy’s Indexed Annuity

Darcy’s indexed annuity is a financial product designed to provide a steady stream of income in retirement. It is a type of annuity that is linked to an underlying index, such as the Consumer Price Index (CPI), which measures inflation.

This means that the value of Darcy’s annuity payments will increase over time in line with the rate of inflation.

Type of Indexed Annuity

There are two main types of indexed annuities: fixed indexed annuities and variable indexed annuities. Darcy owns a fixed indexed annuity, which means that the interest rate on her annuity is fixed for a certain period of time. This provides her with a guaranteed minimum rate of return on her investment.

Terms and Conditions

The terms and conditions of Darcy’s indexed annuity include the following:

- Interest rate:The interest rate on Darcy’s annuity is fixed at 3% for the first five years. After five years, the interest rate will be reset to a new rate that is based on the performance of the underlying index.

- Annuity payment period:Darcy has chosen to receive annuity payments for the rest of her life. She can also choose to receive payments for a specific number of years or for a specific amount of time.

- Death benefit:If Darcy dies before she has received all of the annuity payments, the remaining payments will be paid to her beneficiaries.

Benefits of Indexed Annuities: Darcy Owns An Indexed Annuity

Indexed annuities offer a range of benefits that make them attractive investment options for individuals seeking financial security.Indexed annuities are designed to provide a steady stream of income during retirement while protecting your principal against market downturns. They are also tax-advantaged, meaning that you can grow your savings faster than you could with a traditional investment account.

Financial Security

One of the biggest benefits of indexed annuities is that they can provide you with financial security in retirement. By locking in a guaranteed rate of return, you can be confident that you will have a steady stream of income to cover your expenses, even if the market takes a downturn.

Darcy, with his indexed annuity, has been enjoying financial stability. However, while researching ways to diversify his investments, he stumbled upon an unexpected topic: picadura de arañas en perros . Intrigued, he delved into the subject, learning about the symptoms and treatment options for spider bites in canines.

Despite the digression, Darcy’s focus remained on his indexed annuity, which continued to provide him with peace of mind and a secure financial future.

Tax Advantages

Indexed annuities also offer a number of tax advantages. Earnings in an indexed annuity grow tax-deferred, meaning that you do not have to pay taxes on them until you withdraw the money. This can allow you to grow your savings faster than you could with a traditional investment account, where you are taxed on your earnings each year.In

addition, when you do withdraw money from an indexed annuity, it is taxed as ordinary income, not as capital gains. This means that you will pay a lower tax rate on your withdrawals than you would if you withdrew money from a traditional investment account.

Risks of Indexed Annuities

Indexed annuities, like any financial product, carry certain risks that investors should be aware of before making a decision to purchase one.One of the primary risks associated with indexed annuities is that they can lose value. The value of an indexed annuity is linked to the performance of a specific market index, such as the S&P 500. If the index loses value, the value of the annuity will also decline.

This risk is particularly important to consider for investors who are nearing retirement or who are relying on their annuity income to supplement their retirement savings.Another risk associated with indexed annuities is that they may have surrender charges. Surrender charges are fees that are imposed if the investor withdraws money from the annuity before a certain period of time has passed.

These charges can be significant, and they can eat into the investor’s returns. Investors who are considering purchasing an indexed annuity should carefully review the surrender charge schedule before making a decision.

Comparing Indexed Annuities to Other Investments

Indexed annuities are a type of fixed annuity that offers the potential for growth based on the performance of a stock market index, such as the S&P 500. This can provide investors with the potential for higher returns than traditional fixed annuities, but it also comes with some additional risks.

When comparing indexed annuities to other investment options, it is important to consider the following factors:

- Return potential:Indexed annuities offer the potential for higher returns than traditional fixed annuities, but they are not as volatile as stocks. This can make them a good option for investors who are looking for a balance between growth and stability.

- Risk:Indexed annuities are not as risky as stocks, but they are not as safe as bonds. The value of an indexed annuity can fluctuate based on the performance of the stock market index that it is linked to. This means that investors could lose money if the stock market declines.

- Fees:Indexed annuities typically have higher fees than traditional fixed annuities. These fees can eat into the potential returns of the annuity.

- Liquidity:Indexed annuities are not as liquid as other investment options, such as stocks or bonds. This means that investors may not be able to access their money quickly if they need it.

Indexed Annuities vs. Stocks, Darcy owns an indexed annuity

Indexed annuities are less risky than stocks, but they also have lower return potential. Stocks can be a good investment for investors who are willing to take on more risk in exchange for the potential for higher returns. However, investors should be aware that the value of stocks can fluctuate significantly, and they could lose money if the stock market declines.

Indexed Annuities vs. Bonds

Indexed annuities are more risky than bonds, but they also have higher return potential. Bonds are a good investment for investors who are looking for a safe and stable investment. However, investors should be aware that the value of bonds can decline if interest rates rise.

Indexed Annuities vs. Mutual Funds

Indexed annuities are similar to mutual funds in that they offer the potential for growth. However, indexed annuities are less risky than mutual funds. Mutual funds can be a good investment for investors who are looking for a diversified investment option.

However, investors should be aware that the value of mutual funds can fluctuate significantly, and they could lose money if the stock market declines.

How Indexed Annuities Can Fit into an Investment Portfolio

Indexed annuities can be a good addition to an investment portfolio for investors who are looking for a balance between growth and stability. Indexed annuities can provide the potential for higher returns than traditional fixed annuities, but they are not as risky as stocks.

This can make them a good option for investors who are nearing retirement or who have a low risk tolerance.

Making a Decision

Deciding whether an indexed annuity is suitable for your financial goals requires careful consideration. Evaluate the factors discussed below to make an informed decision.

Factors to Consider:

- Financial Goals:Determine if the annuity aligns with your retirement income needs, risk tolerance, and investment horizon.

- Fees and Expenses:Understand the costs associated with the annuity, including annual fees, surrender charges, and mortality and expense fees.

- Interest Rate Environment:Indexed annuities are linked to market indices, so their performance depends on interest rates. Consider the current and projected interest rate environment.

- Tax Implications:Withdrawals from indexed annuities are typically taxed as ordinary income. Understand the tax implications and how they may affect your overall financial plan.

- Alternatives:Explore other investment options, such as stocks, bonds, or mutual funds, to determine if they better meet your needs.

Steps to Ensure Alignment with Financial Goals:

- Consult with a Financial Advisor:Seek professional guidance to assess your financial situation and determine if an indexed annuity is a suitable investment.

- Compare Annuities:Research different indexed annuities and compare their features, fees, and potential returns to find the best option for you.

- Consider Long-Term Goals:Indexed annuities are designed for long-term investments. Ensure the annuity aligns with your retirement income needs and time horizon.

- Review Regularly:Monitor the performance of your indexed annuity and make adjustments as needed to ensure it continues to meet your financial goals.

User Queries

What is the difference between an indexed annuity and a fixed annuity?

Indexed annuities offer growth potential linked to an inflation index, while fixed annuities provide a fixed interest rate.

What are the benefits of owning an indexed annuity?

Indexed annuities offer growth potential, downside protection, and guaranteed income during retirement.

What are the risks associated with indexed annuities?

Indexed annuities may have lower growth potential than other investments and may be subject to surrender charges.